-jpg.jpeg?width=416&name=iStock-1314979660-min%20(1)-jpg.jpeg)

Artificial Intelligence technologies are increasingly integral to payments, and banks need to deploy these technologies at scale to remain relevant and stay competitive.

Indeed, for global banking, McKinsey estimates that AI technologies could potentially deliver up to $1 trillion of additional value each year. Many banks, however, have struggled to move from experimentation to use AI within payments at scale.

If you’ve already read the last three blogs in this series, you’ll see we’ve talked at length about using AI to gain opportunities from ISO 20022, and how to leverage data from ISO 20022. We discussed how using AI for data cleansing, normalisation, and enrichment are the fundamental starting points for using ISO 20022 data. And after this data has been prepared, the next step is to find innovative ways to apply this data.

As we noted at the beginning of this series, AI can dramatically improve banks’ performance in six key areas: reducing human intervention, detection and prevention of fraud and AML, offering highly personalised products, predictive insights, enhanced data offerings for corporates, and identifying data quality blind spots.

While these key areas are of the utmost importance, they’re not the only benefit that AI and NLP provide. In this highly complex ecosystem, we believe AI has the ability to change the very fabric of this industry - simply, securely, and at scale.

In this article, we take a closer look at real-life client case examples and the real benefits of the effective use of AI techniques.

Data normalisation and enrichment for frictionless payments

The challenge

The bank we worked with had many payment instructions containing unstructured, misformatted, missing or partially filled information. This caused payment instructions to be manually reviewed which caused significant delays and costs, including missing client SLA’s and customer dissatisfaction. On top of this, it also increased inquiry and investigation costs, penalties, and other fees.

How AI helped overcome the challenge

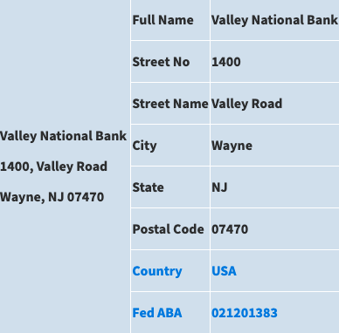

Pelican used AI techniques such as Natural Language Processing (NLP) to understand and normalise unstructured payment instructions such as bank name, branch information, street address, city, state, and country. It also provided the correct bank codes such as BIC, and National Clearing Codes such as US Fedwire, Canadian Transit Code, UK Sort, Indian IFSC or Australian BSB code.

In addition, misformatted or misplaced payment details were extracted, understood, normalised and merged with other information to provide accurate bank codes, account numbers and IBANs.

The result

Payment data normalisation and enrichment provided correctly formatted payments and ensured end-to-end automation without any human intervention. This significantly reduced friction and delays in payments processing and reduced chargeback costs and associated inquiry and investigation costs. The bank achieved more than an 80% reduction in payment processing costs and increased the capacity by 250% without an increase in resources (and associated costs).

Bank name and address normalisation to SWIFT BIC and local clearing code:

Insights and Recommendations

The challenge

Banks historically have been the custodian of crucial customer financial data but have struggled to make sense of their payment data. Now ISO 20022 will provide additional data on payments, which can be leveraged to generate much richer insights into customer behaviour for better customer service and monetise the information.

How AI helped overcome the challenge

By leveraging various AI techniques such as NLP and Machine Learning (ML), Pelican can look at both current legacy, new ISO data and historical payment instructions to:

-

- Improve profitability by cutting costs.

- Optimise revenue by offering new products.

- Provide insights into peer group behaviour and analysis.

- Improve customer engagement by providing intelligent and personalised offerings.

Banks can offer targeted and useful recommendations/products for:

-

- Fee reduction recommendations e.g. highlight duplicate services, reduce the number of subscriptions and reduce higher-than-average bills.

- Provide tips to reduce F/X rate fees or hedging options.

- Cash flow analysis or lending updates.

- Quarterly, half-yearly or annual financial health checks through digital reports providing a visual overview of customers’ (retail, SME or corporate) financial robustness over that period.

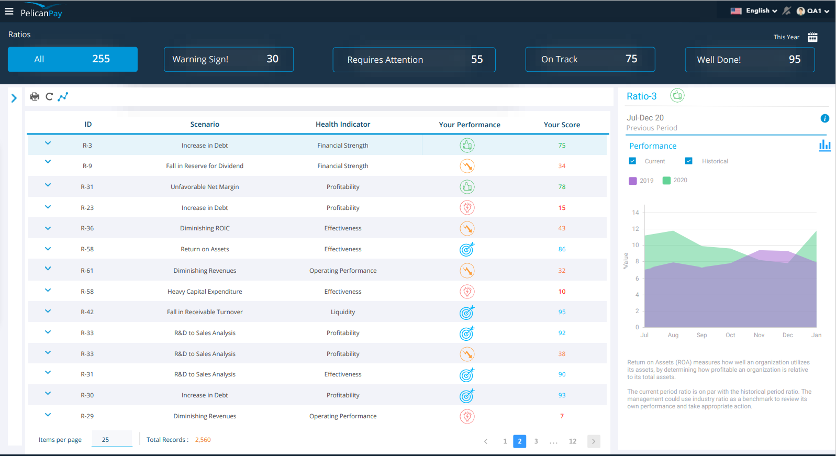

Normalised and enriched data are further leveraged to provide detailed insights, dashboards and reports on customer behaviour and perform peer group analysis on anonymised metadata.

Payments insights and dashboard:

The results

Application of AI-powered advanced analytics techniques on payment data generated in-depth insight into customer behaviour and their needs related to their life stage. These insights helped the bank product and relationship managers create personalised recommendation offerings for customers, such as automatic credit line extensions, better cash visibility, targeted packaged products, and intelligent and actionable financial health checks.

Combined, this enabled banks to improve customer satisfaction and engagement through personalised financial service products and advice, directly attributed to the top-line revenue growth with improved margins.

Continuous optimisations through AI-powered self-learning

The challenge

A payment transaction contains a lot of structured and unstructured information, which historically has required manual interventions at various steps in its processing journey. All such manual interventions affect a key operational efficiency metric, the STP rate.

Banks have troves of historical data that capture and detail instances where manual intervention was required during the payment processing stage. However, it was not possible to understand and learn from the operator’s practical experience and automate payment processing.

Current legacy processing platforms lack the capabilities required to learn from historical repair information and to generate auto-enrichment and auto-repair rules, which through continuous learning and refinement can constantly improve the STP rate.

How AI helped overcome the challenge

Pelican’s Intelligent Payment Services Platform, with its advanced AI-based ML and NLP processing, can understand the logic behind repair and learn from the historical manual repairs carried out by the operators. This allows it to generate actionable repair rules with explanations that, when applied to the new transactions, reduced the manual repair count significantly.

Pelican’s Financial AI Hub (FAH’s) Self-Learning module learns from operators' repair actions and automatically proposes new rules with explanations after a configurable number of learned actions. Pelican applies the approved self-learning models on the payments messages and automatically repairs them without any further manual intervention, improving STP rates.

The results

Pelican's Self-learning optimisation generated repair rules due to its comprehensive and intelligent analysis of historical repairs. When applied to the new transactions, these new rules significantly improved the STP rates, resulting in a reduction in overall manual repairs and a decrease in operational costs. The self-learning solution continuously improved straight-through processing, allowing the bank to target a 95%+ rate in their STP capabilities.

Product innovation and monetisation

The challenge

Some SMEs and Millenials don’t necessarily have the expertise to make complex financial decisions or knowledge about some of the common best practices for financial management and independence. Various studies carried out over the years suggest that customers are open to receiving proactive help, advice, or assistance from their banking partners - provided it is relevant and targeted to meet their specific needs.

Banks and Fintechs can provide personalised guidance and coaching to gain the trust, engagement and confidence of the users, thereby gaining increased commitment and high customer value.

How AI helped overcome the challenge

The bank, by using various AI techniques for analytics and insights on historical transaction data, can extract valuable information to fully engage with customers across various segments (students, professionals, SMEs, corporates) through targeted and personalised offerings.

For example, banks could:

Inform customers via:

-

- Tips on reducing FX rates, reducing expenses and increasing interest income through better saving products.

- Alerts on duplicate transactions, new charges and increased expenses.

- Explanations on spend analysis through expense categorisation of transactions such as entertainment, subscriptions and shopping.

Advise customers on:

-

- Life Events by targeted saving accounts to budget for children’s education, varying product options for buying a car or targeted cover for job loss.

- Financial well-being by providing targeted products to address weaknesses identified through financial health checks and peer-group analysis.

- Achieving financial goals by offering personalised saving products based on spending habits and income analysis.

Assist customers with:

-

- Bill payments by setting up diarised payments, providing automated payment reminders, and prioritising due payments based on payment terms, interest rates, working capital, receivables and payables analysis.

- Retirement Planning by offering personalised long-term and low-risk investment products based on income and expense analysis.

- Loans and mortgages by offering pre-authorised loans and mortgage products based on income and expense analysis.

- ESG credentials by offering products and services to build customers’ ESG credentials. This can be done by continuously advising customers on comparatively low carbon footprint products or services for the activities derived from their transaction data - steering customers towards more sustainable consumption and to meet their ESG objectives.

The results

Pelican’s AI-powered monetisation component, which leveraged actionable insights generated by the insights and recommendations engine, helped the bank’s product and relationship managers to manufacture and offer chargeable and value-add bespoke products and services to their customers. These services not only unlocked new revenue streams for the bank, but also increased customer satisfaction and retention by addressing their immediate and unique needs.

AI delivers real business solutions

Today, banks that recognise the value of AI and technology for better customer and business experience are moving towards modular, resilient and scalable cloud-based platforms.

The distinct advantage of a modular and scalable AI-based platform is the ability to generate detailed analytics and insights into customer behaviour from a large amount of historical, operational and transaction data. Use of these insights can then be used for operational actions and recommendations.

Banks that adopt these futureproof approaches see tremendous benefits:

- Reduced manual intervention is required to make sense of and use unstructured data. This translates into operational efficiencies and costs associated with FTE (full-time employees). For example, banks on average reduce FTE costs by 50% to 60%.

- Improved capacity and scalability are achieved with a reduction in manual work. Payment processing can then be done 24x7 without any errors and verification which allows the capacity to increase by over 250%.

- Improved customer satisfaction and retention as their transactions are processed faster and statements and confirmation are sent expeditiously and meet SLA. Customer satisfaction on average is also improved by 27%.

- Investigation and inquiry-related costs are reduced in the range of 25% - 35% on average.

- The revenue of new products and services increases on average by 20% - 25%. By underpinning new products and services with AI, banks unlock incredible value creation in ways that count for customers.

Striving towards a more intelligent value proposition and smarter experiences and servicing is a critical competitive differentiator as we enter the new era of payments.

A new era of payments

Technology has been disrupting legacy industries for a long time. While payments may have been slow to transform due to their complexities, disruption is already here.

Payments are not only more complicated but often underpinned by legacy systems. AI makes things simpler, smarter, and more secure.

By using an API-based approach, organisations can remain competitive by gaining access to detailed analytics and insights. APIs can handle everything, from AI-powered digital payments and financial crime compliance, to open banking and sanctions screening - while ensuring compliance and security.

Final tips

In order to realise these benefits, here are a few final tips to get started:

- Have a holistic view of your payment infrastructure modernisation with input from all key stakeholders. At a minimum include product management, payments operations, regulatory compliance, technology staff, partners/vendors and even customers.

- The business case should incorporate cost efficiencies, productivity gains, capacity increase, risk reduction and revenue growth.

- As is usually the case with these projects, Senior management buy-in is essential and the agreed plan needs to be implemented step-by-step in a phased manner.

- Finally, it’s key to select a technology partner that has proven AI-based solutions.

In the current payments environment, banks, non-bank financial institutions, and fintechs are faced with the opportunity and challenge of delivering new and compelling services that will meet the increasingly digital, 24x7 demands of their customers.

It’s an exciting time to be part of this dynamic ecosystem and there’s one thing we can all be certain of; AI is the future of payments.

To learn more about how AI techniques in payment processing can reduce costs and improve the customer experience, speak to one of our experts today.